Annual General Meeting of Shareholders for the fiscal year ended December 31, 2017

Opinions of the Company's Board of Directors on shareholder proposals

At the Annual General Meeting of the Company for the year ended December 31, 2017 held on March 21, 2018 ("AGM"), we explained opinions of the Board of Directors on the shareholder proposals received on January 16, 2018 from Oasis Investments II Master Fund Ltd. ("Oasis") as below. For further details of the proposals presented by Oasis and the opinions of the Board of Directors, please refer to "Notice of the FY2017 Annual General Meeting of Shareholders: Reference Documents for the General Meeting of Shareholders."

1. Explanatory materials used by Kumagai and his speech at the Annual General Meeting

I would like to explain how the Board of Directors feel about the shareholder proposals presented by Oasis.

First of all, it’s a given fact that Oasis’s intention is to improve the Company and its corporate value, and we are really grateful for that. As I (Masatoshi Kumagai, CEO, Chairman of the Board and President of GMO Internet Group, Inc. and Group CEO) am the largest shareholder of GMO Internet Group, anyone who wishes to improve our share value is my ally, not my enemy. Some may think that our management and Oasis are at odds over the shareholder proposals, but I completely disagree.

Having said that, the rationale behind the shareholder proposals from Oasis includes misunderstandings, misperceptions of facts, or conjecture of Oasis, and I hope to clear up major differences using these slides. First, the premise and objective of the proposals from Oasis is “transformation into a governance system capable of realizing the sustainable growth.”

Has GMO Internet Group not achieved sustainable growth, then?

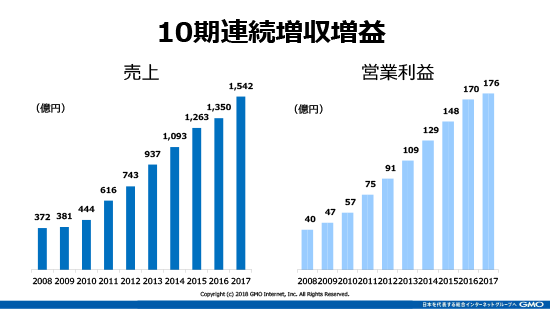

This slide shows our Net sales and Operating profit for the last 10 years. As you can see, GMO Internet, your investee, has survived in the fast-changing Internet industry, continued to grow, and achieved increases in net sales and profits for 10 consecutive years, under the current governance system, that is, the oversight and execution system.

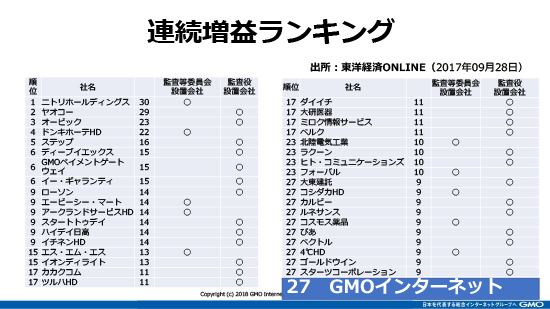

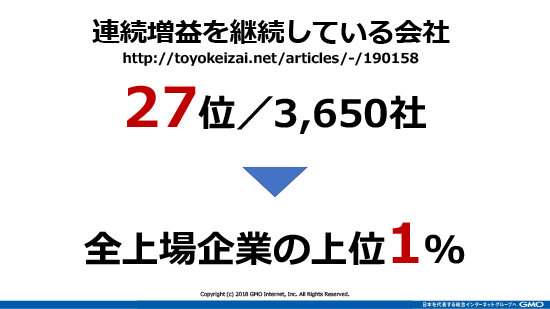

This is the data of “the ranking of companies achieving continuous profit increase” published by Toyo Keizai in September 2017. As you can see, we ranked 27th.

Ranking 27th means that we are among the top 1% of all listed companies. Since this is last year’s data, we may rank even higher this year as we achieved profit increase for 10 consecutive years now. Should a company making the top 1% change its current governance or management system for the purpose of “transforming into a governance system capable of achieving sustainable growth?” I don’t think it should. Like I said earlier, it was stated in the shareholder proposals that agreeing with the proposal will allow us to “achieve sustainable growth,” but we are already doing it.

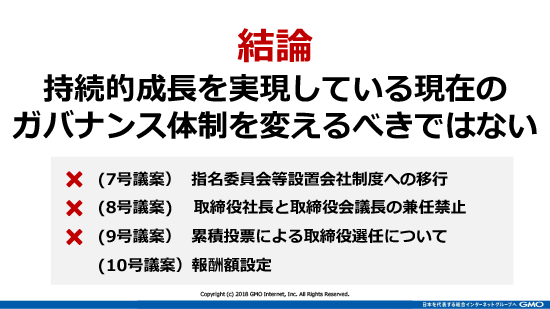

In conclusion, I think this alone should suffice for the reason why we don’t think we should change our governance, that is, our oversight and execution system, which is a base for Proposal 7, 8 and 9 presented by Oasis.

Please let me also add some supplementary notes on other misunderstandings and misperceptions of facts.

Oasis pointed out that “the top-down management is interfering with the effective oversight function of the Company’s Board of Directors.”

Is the Board of Directors of GMO Internet Group, Inc. not functioning effectively because of my top-down management?

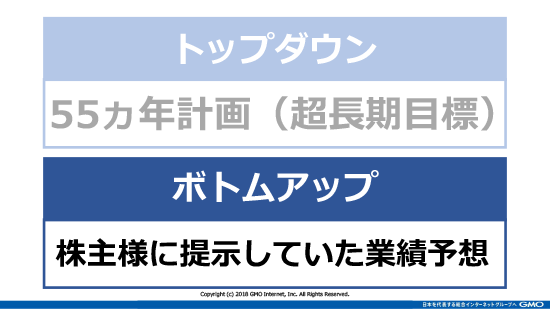

GMO Internet Group has systems under which all employees share big dreams and strive to achieve high goals. One of them is our 55-year plan, an ultralong-term plan we made 20 years ago in 1998. The plan is not perfectly linked to the business performance but sets out goals that we aim to achieve 55 years after the plan was prepared, including net sales, profits, and the number of partners (employees) and group companies. Currently, there are some differences, but the entire Group is pursuing these figures. We have continued this pursuit for over 20 years, shared with everyone and managed the Group. As Oasis pointed out, these are top-down figures.

On the other hand, the performance forecast which was disclosed until last year (the performance forecast will not be disclosed from FY2018) is a bottom-up figure determined at the annual group management camp. What we call in the GMO Group term “90 Purity” means approval from over 90% of participating executives. We deliberate and approve budgets submitted by group companies with 90 Purity at the budgeting camp and disclosed them to you every year. The decision as to how to achieve those budgets approved at the camp is left to each executive.

For example, I take initiative in some new businesses, such as cryptocurrency mining business, in a top-down way. But in other existing businesses, everything from budgeting to daily operation is executed in a bottom-up way, and that’s GMO Internet Group. GMO Internet Group has systems capable of achieving performance goals without top-down instructions from me. Such systems are our strengths.

I don’t think I need to explain how fast the Internet industry is expanding and changing. In order to make decisions promptly, generate profits, and continue to grow in such a fast-changing Internet industry, it is critical to have a self-acting system. If everything required top-down approvals in a huge pyramidal structure and if I had to make every single decision, we wouldn’t have a chance to survive in this industry.

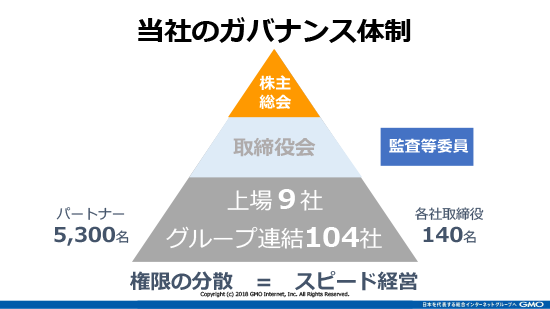

This is what our governance system looks like. Guidelines for governance, such as “Practical Guidelines for Corporate Governance Systems” published by Ministry of Economy, Trade and Industry on March 31, 2017, state that it is desirable to separate the oversight function and the execution function, and not desirable for the head of the execution function to become a director. However, in order to “win” in the fast-moving Internet industry, I believe we need to make decisions at a tremendous speed in response to changes in environment and be able to act on its own at a tremendous speed.

GMO Internet Group, consisting of 9 listed companies and 104 consolidated companies, is managed by delegating authorities to professionals in each sector and making decisions and putting them into action ahead of our competitors. If the oversight function and the execution functions are separated, can external directors alone make decisions fast enough to cope with the fast-changing industry? I can’t imagine external directors who are familiar with both the fast-changing Internet industry and the strengths of our Group. What the guidelines state does not necessarily apply to all companies. I strongly believe we should avoid denying and destroying organizations and systems demonstrating results just because they are “different from guidelines.”

As companies grow, issues regarding appointment of officers and officers’ remuneration will always arise. However, we came up with a system that eliminates any arbitrary decisions and allows everyone to concentrate on the management in a fair environment without worrying about what I think. Appointment of officers and determination of officers’ remuneration are not carried out by “Nominating committee” and “Compensation committee,” respectively, as stated in the guidelines, but we have a more transparent system than what the guidelines suggest.

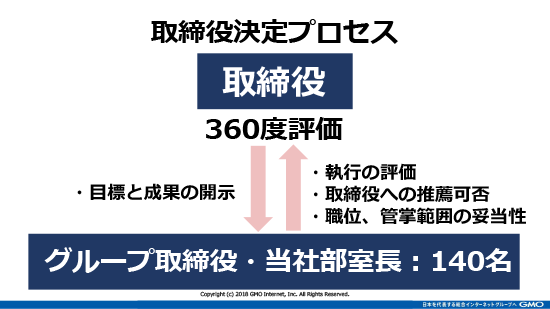

All directors of the Company, including myself, are subject to a 360-degree evaluation by all directors and officers of group companies and those at the level of division managers and above at the headquarters, 140 in total. They anonymously answer questionnaires consisting of evaluation of the directors’ execution of their duties and personality and a question whether to recommend them as director in the next year, etc. All evaluations with honest comments, good or bad, are fed back to directors and also disclosed to all evaluators so as to benefit for their growth.

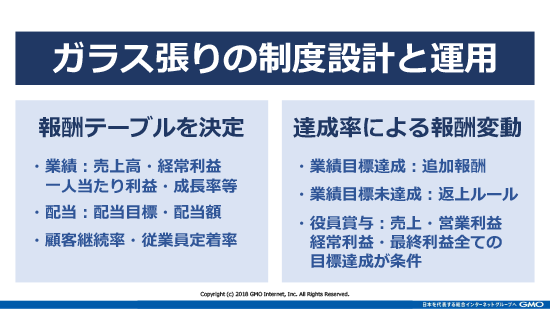

We have a system to determine officers’ remuneration which no one complains about. I think there are very few companies in the world that have a system like this. In most companies, presidents and founders usually have to negotiate with officers about their remuneration every year. I have not negotiated with officers about their remuneration for over ten years. Let me explain how it works.

First, I ask for volunteers from 140 executives to “decide remuneration and the system” every year. This will eliminate “any complaint about remuneration or the system.” Next, I ask for volunteers to “complain later” from the rest of the executives. Then, a group to consider remuneration is formed with those who want to develop the system and who complain later. The rest of the members will leave everything to those who volunteered. The group members will improve the system by disclosing proposed improvement to the rest of the members and asking for opinions from time to time until the system obtains 90 Purity and becomes the remuneration system for the year. Of course, I’m not a member of this group and don’t make any comments.

The remuneration system consists of various items that award points to officers automatically, based on which remuneration is determined automatically. All 5,300 employees of the Group can see how the system works, and goals set by officers and remuneration of all officers on the intranet portal from the day they join the Group. My past remuneration as well as those of officers here are all disclosed. I don’t think there is more transparent remuneration system than this. Oasis requested that we should “disclose the remuneration system to shareholders” and “disclose it to external parties.” But this is a company secret and our competitive power. But I believe this is much more transparent than disclosure to external parties.

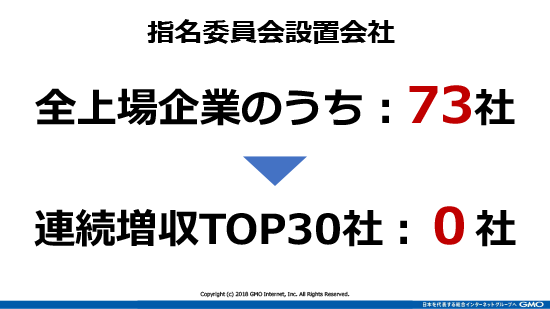

Now, about Proposal 3 presented by Oasis, there are only 73 companies among all listed companies that have a nominating committee, which is not many. And there is none among those included in the table listing companies with continuous profit increase that I explained earlier. Even if we don’t do what the guidelines suggest, such as having the nominating or remuneration committee, we can still have a more transparent system by developing it on our own.

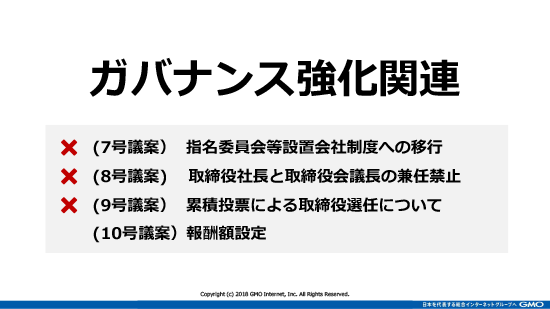

In conclusion, because the premise of the top-down management is not true, and also because of other reasons I just explained, we believe Proposal 7, 8, and 9 are not necessary for us, or rather, we are better off not accepting them.

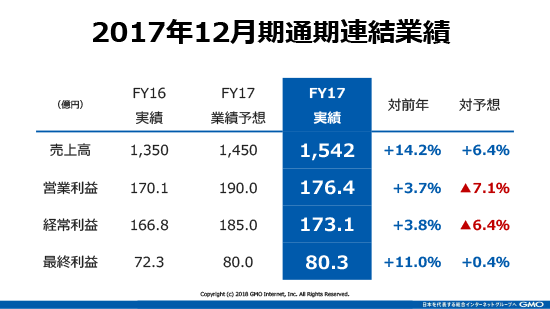

Next, I will explain briefly about our views on Proposal 10 about remuneration presented by Oasis. First, this is last year’s performance results to be used as a base to determine the remuneration.

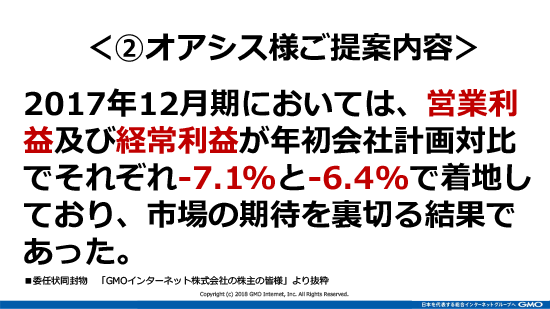

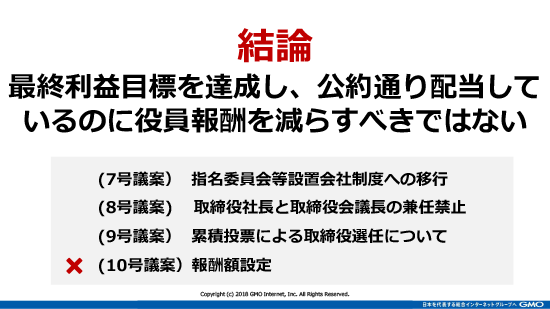

Oasis proposed “to reduce officers’ remuneration because operating profit and ordinary profit fell below the forecasted results for FY2017.”

Our performance results for FY2017 are shown on the slide. As pointed out by Oasis, operating profit and ordinary profit slightly fell below the forecast because we couldn’t make up for the shortfall which occurred in the financial business in the first quarter. However, the bottom line which is the source of the dividend to shareholders achieved the budget.

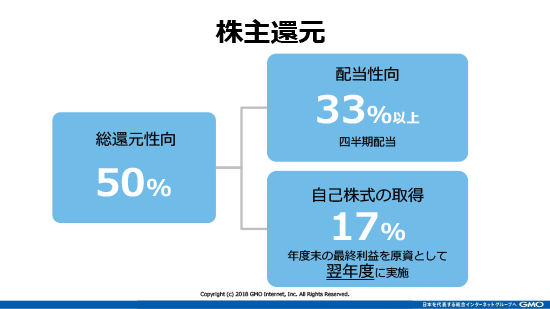

Of the final profit, 33% is allocated to dividends and 17% is used to purchase treasury stock, which is subsequently cancelled every year. As a result, the ratio of total shareholders return is 50%. A half of the final profit is returned to shareholders. In FY2017, we paid promised dividends in full.

We want to bring smiles to the faces of all of our stakeholders including our customers, shareholders, and colleagues. We bring smiles to the faces of our customers by providing No.1 products and services. Seeing their smiles brings pride and smiles to our colleagues who provide services. Such combination of smiles leads to our profits, which then is returned to our shareholders and makes them smile. We believe that our mission as officers of GMO Group is to realize such chain of smiles among these three parties.

“Ri” in Rieki (meaning “profit” in Japanese) represents “Ri” in Rinen (meaning “philosophy” in Japanese). Our officers’ philosophy is to create those three smiles and receive remuneration as a result. The proposal to halve officers’ remuneration even though we paid dividends and made everyone smile is against our philosophy.

Because of those reasons, we are against Proposal 10 presented by Oasis.

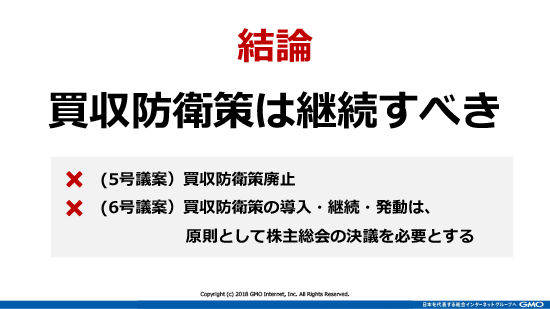

Lastly, I would like to explain about the takeover defense measures relating to Proposal 5 and 6 presented by Oasis. The measures were introduced in 2006 but not for the management’s self-protection. As a leading internet infrastructure operator in Japan, we have business and services to protect for our customers, and the takeover defense measures were introduced to continue our long-term growth as a company.

I’m sure you use your smartphones and PCs to search the web every day. 90% of domains of Japanese websites appearing in the Google search results is registered through our service. And over 50% of the websites you see is stored in our data center. We are the behind-the-scenes company of the Internet business in Japan. But it’s not just one company, but the group as a whole.

We have no intention of rejecting constructive acquisition proposals, or all hostile acquisitions for that matter. However, we believe we should not accept abusive acquisitions that may damage our corporate value supporting the Japanese Internet business and acquisitions that do not contribute to maximization of our corporate value. We intend to make every decision taking into consideration the overall benefits for our stakeholders including our customers, colleagues, and shareholders as well as the balance between benefit of three stakeholders. I think it’s not a bad idea to have in place procedures and contents of the measures we should take against abusive acquisitions in advance.

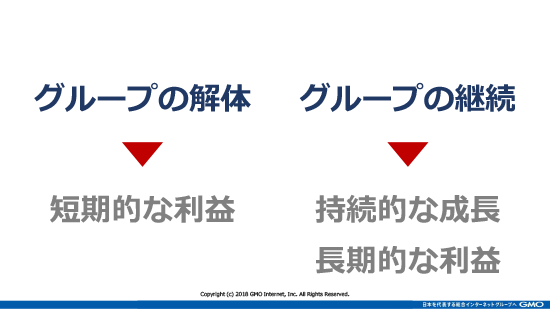

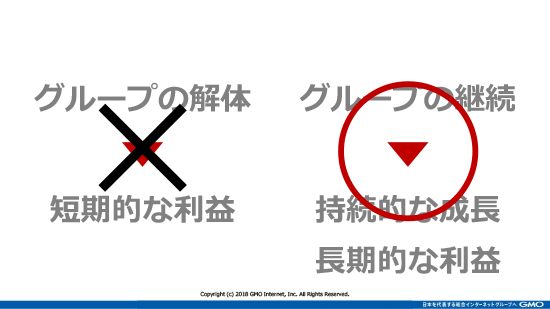

Oasis claims that “the corporate value of GMO Internet Group, Inc. is lower than the aggregate market capitalization of all listed group companies.” It means if you were to buy GMO Internet Group, Inc. in a hostile acquisition, break up the Group and sell the shares, theoretically, you would get more cash than the acquisition price. However, in case of a holding-operating company like us, simple calculation doesn’t add up because we make investments in various businesses. The sum of each company’s value doesn’t necessary match the Company’s value.

Sometimes, we do things together as a group or help each other, and therefore if someone tried to break up our group in a hostile acquisition, it could result in shutting down a great deal of the Internet infrastructure in Japan. We must reject such hostile acquisition.

We consider hostile acquisitions to be M&A deals in pursuit of short-term profit which could not protect our customers and services and end up damaging the Group’s value. This system has been introduced as part of our risk management measures to protect our business, customers, shareholders and colleagues against such possibilities, and such decision requires thorough understanding of our business and operations as well as expertise on M&As.

Accordingly, we believe having the Board of Directors and special committee members is quite beneficial. In its proposals related to abolition of the takeover defense measures and enhancement of governance, Oasis alleged that there may be cozy relationship between our external officers and special committee members because they have been “in the position for so long” and their check-and-balance function may not be effectively working. But I think this is very insulting allegation against our external directors and special committee members. I would like to emphasize once again that they have been appointed not based on the length of service but on the comprehensive assessment of their personality, experience and insights.

As for external officers’ term of office, some countries, including the U.K. and France, set term limits. On the other hand, there are also countries like the United States that do not have any limits. This is because there is an argument as to whether to change external directors who have accumulated insights over the years simply based on the term while there are also concerns over possible integration of external officers and the management. In conclusion, I think there is no right answer worldwide yet regarding the external officers’ term of office and corporate governance itself. Anyway, because of these reasons, the Board of Directors is against Proposal 5 and 6 presented by Oasis.

And finally, please let me talk about what we believe is the most important thing in corporate governance.

Corporate governance which is a system of oversight and execution is very important to companies. But I think the most important thing is personality of the management. Love and gratitude. Willingness to make all of our stakeholders including customers, colleagues and shareholders happy and smile. Having quality to care about them is most important to the management. All candidates for directors are selected based on such quality.

2. Our opinions on other matters pointed out

Our opinions on misperceptions of facts and misunderstandings included in other matters pointed out by Oasis via our website or letters sent to our shareholders are as follows.

2-(1) Our comment on the letter enclosed with the proxy "To shareholders of GMO Internet Group, Inc."

2-(2) Our comment on the matters posted on the website by Oasis

2-(3) Our comment on the statement by Oasis published on "PR Times" on March 9, 2018