Corporate Governance Policy

[Chapter 1] General Provisions

1.Basic Approach to Corporate Governance

The GMO Internet Group, under its corporate catchphrase "Internet for Everyone," is committed to creating new Internet culture and industries, delivering delight and inspiration to customers, and contributing to society and people.

To clearly articulate the fundamental principles underlying its business activities, the Group has stipulated in its Articles of Incorporation the "GMO-ism"—a collective term encompassing the corporate philosophies and mottos of the GMO Internet Group, including the "Spirit Venture Declaration," which embodies the founding spirit of the Company.

In order to earn the trust and meet the expectations of all stakeholders—including shareholders, customers, business partners, and partners (employees)—the Company places strong emphasis on corporate governance. While enhancing soundness and transparency in management, the Company strives to ensure agile decision-making and proper operations, with the aim of achieving sustainable improvement in corporate value.

[Chapter 2] The Company's Code of Conduct

1.Relationship with Stakeholders

1.1.Basic policy

In the Spirit Venture Declaration, one of the GMO-ism, we state that "A company is a tool for the happiness of everyone involved, including colleagues, shareholders, and customers. The barometer is a smile." Through our corporate activities, we will strive to enhance our corporate value by creating smiles on the faces of our stakeholders.

1.2.Related party transactions

The Company requires that any conflict of interest transactions involving executives be approved in advance by the Board of Directors.

In cases where the Company is to perform transactions with officers, major shareholders, etc. ("related party transactions"), an internal committee (members of which consist of External Directors, etc.) or a third-party committee (members of which consist of lawyers, etc.) are established depending on the qualitative and monetary materiality, to verify the objectivity and validity of the transaction before submitting a proposal for approval of the transaction to the Board of Directors.

When a conflict of interest transactions or related party transaction is subject to a resolution for approval at the meeting of the Board of Directors, any Director who is related to such transaction may not participate in the resolution on the ground of being a person with special interest, and therefore is not included in the quorum.

2.Relationship with Shareholders

2.1.General Meeting of Shareholders

The Company positions the General Meeting of Shareholders as its supreme decision-making body, ensures a sufficient period for exercising voting rights, and has developed an environment in which rights can be exercised in an appropriate manner.

- 2.1.1.

-

Efforts are made to provide an easy-to-understand explanation in the notice of convocation, and to disclose it as early as possible. The content of the notice of convocation is disclosed in both Japanese and English at the stock exchange, the Electronic Voting Platform, the Company's website, etc.

- 2.1.2.

-

To enhance the convenience of the exercise of rights for shareholders, the Company introduces a system for viewing notice for convening an Annual General Shareholders Meeting, electronically exercising voting rights, and the Electronic Voting Platform.

- 2.1.3.

-

We have adopted a virtual-only shareholder meeting with an aim to facilitate, improve the efficiency of, and activate the shareholders meeting by making it easier for shareholders - such as those in a remote place - to attend.

- 2.1.4

-

When institutional investors, etc. who hold shares under the name of a trust bank, etc. make a request in advance to exercise its shareholder rights such as exercising voting rights at the General Meeting of Shareholders, the Company will discuss issues with the trust bank, etc. Additionally, when such institutional investors, etc. wish to observe the General Meeting of Shareholders, such observance will be permitted after completing the prescribed procedures.

2.2.Securing the rights and equal treatment of shareholders

- 2.2.1.

-

In order to substantially secure the rights of shareholders, the Company appropriately cooperates with them by giving due consideration to the smooth exercise of the rights of them. In addition to ensuring equal treatment of shareholders, the Company also gives due consideration to the exercise of rights of minority shareholders.

- 2.2.2.

-

When a proposal made by the Company is approved at the General Meeting of Shareholders in spite of a considerable number of negative votes, the Board of Directors will analyze the reasons for such negative votes, and examine necessary measures to be taken accordingly.

2.3.Dialogue with shareholders

- 2.3.1.

-

Basic views

For the sustainable growth and increase of corporate value over the mid- to long-term, the Company believes that it is important not to generate a gap between the top management of the Company and capital markets in the understanding of the Company's situation, and therefore holds constructive dialogues with shareholders and investors on an ongoing basis. To bring about such dialogues, the Company has in place an investor relations structure centering on the Director in charge of investor relations (currently the Deputy CEO), and proactively creates opportunities to hold dialogues with shareholders and investors. In engaging in dialogues with shareholders and investors, the Company makes it a basic policy for the CEO, CFO, and other top management members to provide explanations in their own words and to also respond to questions in person in Q&A sessions.

- 2.3.2.

-

Designation of a director who oversees the overall dialogues with shareholders and measures for positive collaboration among internal departments to support dialogues

The Director in charge of investor relations oversees dialogues with investors and shareholders, while taking charge of the Group Finance Department, the department in charge of investor relations, in an effort to promote departmental collaboration on a daily basis.

- 2.3.3.

-

Means of dialogues other than individual meetings

The Company makes it a basic policy for members of the CEO, CFO, and other top management members to provide explanations of financial results and hold Q&A sessions, both in person, targeted at securities analysts, shareholders and investors on a quarterly basis. The Company provides real-time streaming in Japanese, as well as streaming of recorded video in both Japanese and English.

- 2.3.4.

-

Measures to relay shareholders' opinions and concerns

The Director in charge of investor relations periodically reports opinions and concerns gathered through dialogues with shareholders to the board of directors.

- 2.3.5.

-

Measures to control insider information

When engaging in dialogues with shareholders, in accordance with the IR Policy, information is managed properly and consideration is given so that insider information will not be conveyed to them.

- 2.3.6.

-

Addressing the implementation of management conscious of capital costs and stock prices

The company considers ROE (Return on Equity) as one of the important indicators. To practice management conscious of shareholders' capital costs, the company strives to maintain and improve a high ROE that exceeds the cost of shareholders' equity. At the same time, the company is committed to optimizing the balance between maintaining financial soundness and shareholder returns.

Moreover, to mitigate information asymmetry between the stock market and the company and contribute to the reduction of capital costs, the company strongly recognizes the importance of appropriate "information disclosure" and IR (Investor Relations) activities. Through improving the quality and quantity of these efforts, the company is committed to ensuring that the market appropriately and fully evaluates the company's growth potential.

2.4.Basic policy for capital strategy

- 2.4.1.

-

The Company is committed to increasing its profits. In order to achieve sustainable profit growth, we consider proactive investments both in domestic and foreign investment domains to be necessary. The Company will maintain sufficient shareholders' equity for future investments for growth and to tolerate risks.

- 2.4.2.

-

With respect to shareholder returns, the Company targets a total shareholder return ratio of 50%. 1) The target for dividend payout ratio is set at 33% or more of net income attributable to owners of the parent, while 2) we take a flexible approach towards repurchasing our shares according to the share price, by comprehensively taking into account our business performance and financial structure, etc., with a target amount of 50% of net income attributable to owners of the parent less total dividends paid.

- 2.4.3.

-

In case of a financing, etc. that may cause a change in control or a significant dilution of shares, the Company will carefully consider the necessity, rationale, use of capital, plan to recover the amount invested and other matters concerning the financing, etc. so as not to harm the interests of shareholders and provide a sufficient explanation to them.

2.5.Policy for cross-shareholding

The Company makes investments solely for the purpose of pure investment, and does not have a policy to hold shares for cross-shareholding. In cases where the Company invests in shares, the Group Investment Strategy Office takes charge of cases involving alliances and minority investment cases. Whether or not to make investments will be determined after careful deliberation at the meeting of the Board of Directors or the Management Council depending on the qualitative and monetary materiality according to the materiality of each case, taking into account detailed examination by each department.

2.6.Anti-takeover measures

Our Board of Directors believes that because the Company is a public company and its shares are freely traded, trading in the Company shares should be left in the hands of markets, and any decision concerning the acceptability of a Large-Scale Purchase*1 by a Certain Group*2 should ultimately be left to the Company shareholders who own the Company shares. Should a Large-Scale Purchase be contemplated, we believe that it is indispensable that, in order to allow our shareholders to decide on the acceptability of the Large-Scale Purchase, not only the information provided in a one-sided manner by the Large-Scale Purchaser*3, but also information from our Board of Directors, which is entrusted with the company's operations and information including assessments and opinions of our Board of Directors with respect to the Large-Scale Purchase should be provided. The GMO Internet Group focuses its business resources on the Internet market with high growth potential, under the corporate slogan "Internet for Everyone." The GMO Internet Group has been providing a full range of Internet-related services, chiefly in the following four areas:

- (1)

-

Internet Infrastructure business;

- (2)

-

Internet Finance business;

- (3)

-

Online Advertising & Media business; and

- (4)

-

Cryptoassets business.

These operations are not independent, but rather function as one, mutually and organically, and exert synergies that allow for the creation of greater corporate value. Internet-related technologies develop at an extremely rapid pace and, accordingly, industry standards and customer needs also change rapidly. The Company believes that, with respect to our management, it is indispensable for such management to understand: the specialized nature of its operations described above, management know-how based on a high degree of expertise related to its Internet-related services, as well as the relationships among the stakeholders, such as the Company's personnel who have the techniques and skills necessary to cope with technical innovations, the entities of GMO Internet Group that carry out their business within the company group, united as one, organically, its trading partners and clients.

We believe that without such an understanding of the Company's operations, it will become difficult to grasp the corporate value of the Company fully, and, it is extremely important that for purposes of our shareholders evaluating a Large-Scale Purchase by a Large-Scale Purchaser, our shareholders not only be given information by the Large-Scale Purchaser, but also the assessments and opinions of our Board of Directors—which fully understands the specialized nature of the Company's operations—concerning the proposed Large-Scale Purchase.

Operating along the lines of this thinking, our Board of Directors believes that it will contribute to the common interests of our shareholders and our corporate value to draw up a set of rules concerning Large-Scale Purchases of the Company shares (hereinafter referred to as the "Large-Scale Purchase Rules"), to collect and provide information that is necessary and sufficient for our shareholders to assess the Large-Scale Purchase, and thereafter to formulate and disclose the opinion of the Board of Directors after assessing and reviewing such information. Our Board of Directors will require any prospective Large-Scale Purchaser to comply with the Large-Scale Purchase Rules. In a case where a Large-Scale Purchaser does not comply with the Large-Scale Purchase Rules, a case where it is judged that a Large-Scale Purchase carried out pursuant to the Large-Scale Purchase Rules would have the effect of seriously harming the common interests of our shareholders and our corporate value, or a case where invoking the countermeasures is approved by the shareholders at the shareholders' meeting, our Board of Directors will be in a position to take certain countermeasures that it judges to be appropriate at that point.

A policy toward Large-Scale Purchases of our shares was decided initially in the Company's Board of Directors' meeting held on March 13, 2006, for the purposes described above. Since then, the initial Board of Directors' meeting, held after the Annual General Shareholders Meeting scheduled for every year, has decided to continue such policy.

After fully considering changes in the external environment, the "Action Guidelines for Corporate Takeovers" announced by the Ministry of Economy, Trade and Industry on August 31, 2023, and recent court precedents, as well as listening to the opinions of market participants, etc., and making a comprehensive judgment, the Board of Directors of the Company at its meeting held on March 21, 2025, after the annual shareholders' meeting of the Company held on the same day, decided to continue the policy. (hereinafter referred to as the "Policy").

The Policy will be implemented only if large-scale purchaser violates the rules set forth in the Policy or if a large-scale purchase of the Company's shares significantly compromises the common interests of shareholders and the corporate value. In addition, a special committee, an independent body from our Board of Directors must be established and their opinions must be respected to the greatest extent possible, and all directors including three external directors who are independent officers must be in favor of implementing countermeasures with regard to the implementation of the Policy, so we do not allow the Board of Directors to implement countermeasures for the purpose of defending their own interests.

[Chapter 3] Disclosure of Information

1.Full disclosure

The Company endeavors to distribute corporate information in a prompt, fair, accurate and easy-to-understand manner to all stakeholders including shareholders, investors, institutional investors, and securities analysts.

2.Disclosure policy

2.1.Results forecast and future outlook

- 2.1.1

-

The Company will disclose its detailed financial results on a quarterly basis for the convenience of all stakeholders. Plan, outlook, strategy, and other information (that are not historical facts) announced by the Company are outlooks made at the time of the announcement, and therefore their validity is not guaranteed. The Company does not endorse any third-party forecasts of the Company's results.

- 2.1.2.

-

Information disclosed at engagements with securities analysts and institutional investors Information announced at engagements with securities analysts and institutional investors held by the Company will be limited to facts disclosed to the public in the financial results, facts that are in the public domain, general business environment, etc. No reference whatsoever will be made to undisclosed "material facts."

- 2.1.3.

-

Disclosure method

Disclosure pursuant to laws such as the Companies Act and the Financial Instruments and Exchange Act will be duly conducted according to the method prescribed by laws and regulations. In regards to disclosure that falls under the rules for timely disclosure, the Company will provide an explanation in advance to Tokyo Stock Exchange, Inc. (TSE) in accordance with said rules, register the information on the "Timely Disclosure network (TDnet)" provided by TSE and provide the same information promptly to the news media. The Company will promptly post the information disclosed via TDnet on its website after announcing the information to the news media and confirming that it is posted on the "Company Announcements Disclosure Service" on TSE's website, in accordance with the Financial Instruments and Exchange Act and the rules for timely disclosure.

For information that does not fall under the rules for timely disclosure, it shall be delivered to shareholders and investors in an accurate and fair manner by an appropriate method in accordance with laws and regulations such as the Financial Instruments and Exchange Act, etc.

- 2.1.4.

-

Mid-term business plan

The Company neither formulates nor publishes a mid-term business plan, based on its view that in a rapidly-changing Internet industry, the validity of a mid-term business plan would be limited even if time and effort are spent on its formulation, and that numerical targets contained therein may likely mislead shareholders and investors. As it is difficult to forecast business results because of our Internet Finance and Cryptoassets businesses that are affected by market volatility, such as the socioeconomic conditions and the financial market, we no longer disclose our guidance since fiscal year 2018.

On the other hand, as a long-term internal commitment, the Company has set forth its "55-Year Plan," aiming to achieve ¥10 trillion in revenue and ¥1 trillion in recurring profit by 2051. To achieve this goal, the Company has formulated a consolidated management plan based on the fundamental principle of achieving annual operating profit growth of over 15%. The policies derived from this management plan are communicated to shareholders and investors during earnings presentations.Furthermore, the Company has in place a monitoring function that involves sufficient analysis and evaluation on a weekly basis of discrepancies between a single-year business plan and actual results at the Group executive joint meeting consisting of Directors, group executive officers, and senior management of Group companies. The Company conducts analysis and takes measures as appropriate through such monitoring, and the highly effective execution of the business plan translates into the Company's growth.

[Chapter 4] Corporate Governance Structure

1.Organizational Structure

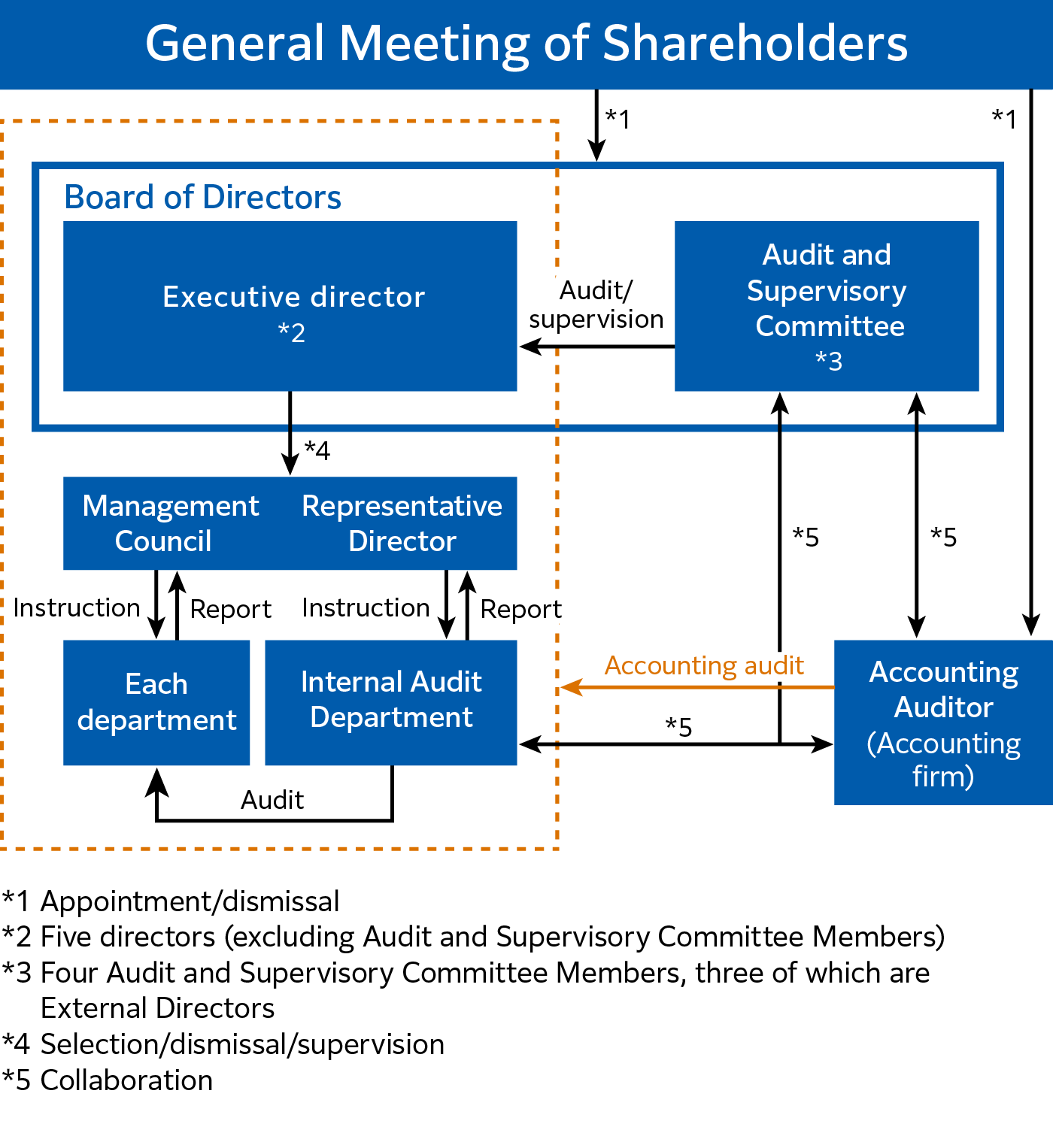

The company has chosen to be a company with an Audit and Supervisory Committee as its organizational structure under the Companies Act. The Audit and Supervisory Committee is comprised of Audit and Supervisory Committee members who are non-executive directors, and the majority of these members are independent outside directors. By being responsible for auditing and supervising the legality and appropriateness of business execution, the Audit and Supervisory Committee aims to achieve more transparent management and build a system that can more accurately meet the expectations of all stakeholders.

In order to realize agile decision-making, the Company has established certain monetary standards in its Rules of the Board of Directors and Management Council Regulations, and delegates part of the authority of the Board of Directors to the Management Council according to said standards in order to separate the decision-making authority into the Board of Directors and the Management Council.

Furthermore, we adopt a group executive officer system to strengthen and separate business execution function and oversight function over management decisions.

2.Board of Directors and Management Council

In order to build a highly agile business execution structure, in addition to matters to be resolved by the Board of Directors pursuant to laws and regulations or the Articles of Incorporation, etc., the Company has individually set standards for matters to be resolved at the Board of Directors, and clarified the matters that are considered appropriate for resolution by the Board of Directors in the Rules of the Board of Directors. As a body to discuss matters with managerial importance but are not designated as matters to be resolved at the Board of Directors, the Company established the Management Council consisting of executive directors including the Representative Director, full-time Audit and Supervisory Committee Members, group executive officers, and other members of the senior management.

2.1.Roles and responsibilities of the Board of Directors

- 2.1.1

-

The Board of Directors is responsible for enhancing corporate value in a sustainable manner as well as increasing the common interests of shareholders, and will exercise its oversight function and make appropriate decisions based on fair judgment.

- 2.1.2.

-

In order to fulfill its fiduciary responsibilities, the Board of Directors will exercise its oversight functions over overall management to ensure fair and transparent management through the nomination of Directors and Audit and Supervisory Committee Members and the appointment of group executive officers, determination of the remuneration for Directors, Audit and Supervisory Committee Members, and group executive officers, and making decisions on important business executions.

- 2.1.3.

-

As a specific standard for determining matters to be submitted to the Board of Directors, the Rules of the Board of Directors prescribes the monetary standards, etc. and clarifies the scope of decision-making.

- 2.1.4.

-

The Board of Directors delegates the authority of decision making on matters other than those to be decided by the Board of Directors to the Management Council, Representative Director, etc. in accordance with the standards prescribed in the Management Council Regulations and other internal rules.

- 2.1.5.

-

To enhance corporate governance, the Board of Directors makes a monthly report including a report on the oversight of execution of duties of Directors, and a quarterly report on internal audit and compliance.

- 2.1.6.

-

The Board of Directors has established a system to appropriately respond to cases in the event Audit and Supervisory Committee Members and/or the Financial Auditor discover a misconduct and request the Company to take appropriate actions, or in case where they identify a deficiency or a problem.

- 2.1.7.

-

For human resources development to foster successors to the senior management including the group executive officers, based on certain rules and frameworks and in light of the management philosophy and management strategy, the Board of Directors engages in autonomous organizational operation and corporate management that do not rely on a specific corporate manager.

The Company offers opportunities to its staff members to gain knowledge and understand the roles and responsibilities required for a successor by taking part in management through participation in the meetings of Board of Directors and the Management Council.

As a characteristic of Group management, the members of the Board of Directors and the Management Council are comprised of founders or representatives of major Group companies, all of whom have been brought together under the GMO-ism.

Accordingly, the senior management is comprised of a group of corporate managers who share the common management philosophy. The Company has thus created a program to develop successors to the senior management of the Company as a listed company, through the participation of such corporate managers in the meetings of the Board of Directors and the Management Council.

2.2.Composition of the Board of Directors

- 2.2.1

-

Under the "Venture Spirit Declaration", one of the GMO-ism, which states that "We do not tolerate prejudice on the grounds of race, nationality, gender, educational background, language, religion, or any other factors. We value people for their ability and merits," human resources with diverse skills, insight, and experience show their abilities at the Company. Upon the appointment of Internal Directors, the Company appoints persons with specialized knowledge of business segments and business administration and with diverse background from within the Group, based on the criteria and selection method unique to the Company.

- 2.2.2.

-

The Board of Directors is made up of five Directors with specialized knowledge of business segments and business administration in the GMO Internet Group and four Audit and Supervisory Committee Members, including the three Independent External Directors, so Independent External Directors comprise a third of the members of the Board of Directors as a whole. Group executive officers and other members of the senior management attend Board meetings to give the information needed for the Board of Directors to deliberate and decide on material facts concerning the Company and its Group companies.

- 2.2.3

-

For the appointment of External Directors, persons with a high level of expertise such as lawyers are appointed, thereby realizing balance and diversity in the composition of the Board of Directors as a whole in terms of knowledge, experience and skills.

2.3.Roles, responsibilities and composition of the Management Council

- 2.3.1

-

To strategically and efficiently implement corporate management with agility, the Management Council deliberates and decides on important matters relating to the Company and its Group companies within the scope of authority delegated by the Board of Directors in principle on a weekly basis.

- 2.3.2.

-

The Management Council is comprised of executive directors including the Representative Director, full-time Audit and Supervisory Committee Members, group executive officers, and other members of the senior management.

2.4.Structure to support the Board of Directors and the Management Council

- 2.4.1

-

The Company establishes a secretariat to the Board of Directors and the Management Council to enable sufficient discussions at their meetings

- 2.4.2.

-

The secretariat has developed an environment in which members of the Board of Directors and the Management Council can participate in deliberation and decision-making from remote locations, including distribution of meeting materials using special tools.

- 2.4.3

-

The secretariat prepares the annual schedule for the Board of Directors and the Management Council.

- 2.4.4.

-

The secretariat sets an appropriate time for deliberation so that sufficient discussions can be held at the meetings of the Board of Directors and the Management Council.

- 2.4.5

-

To ensure that sufficient discussion takes place at the meetings of the Board of Directors and the Management Council, the secretariat sends out meeting materials well in advance of the meeting date for the convenience of the attendees.

- 2.4.6.

-

The secretariat provides information required for decision-making by Directors, Audit and Supervisory Committee Members, group executive officers, and other members of the senior management as needed.

2.5.Evaluation of the Board of Directors

The company, with the Audit and Supervisory Committee at the center, conducts timely analysis and evaluation of the effectiveness of the Board of Directors and strives to enhance its functions.

- 2.5.1.

-

Analysis and Evaluation Methodology

Method of Evaluation: Self-evaluation through a questionnaire

Subjects of Evaluation: Directors (including outside directors and Audit and Supervisory Committee members) and Group Executive Officers Implementation Period: January 2025 (once a year) Evaluation criteria: (i) Management strategy, (ii) Corporate governance, (iii) Corporate ethics and risk management, (iv) Dialogue with stakeholders such as shareholders, etc.

- 2.5.2.

-

Summary of results:

The Company continued to receive high evaluations for its execution of management strategies based on GMO-ism and its practice of transparent ("glass-box") management.

In addition, the Company received higher marks than in the previous year for maintaining fair corporate management practices, including the proper development of internal control and risk management systems, and the implementation of fair and highly transparent procedures in the appointment and reappointment of senior executives.

Further improvements were recognized in areas such as securing sufficient time for deliberation by the Board of Directors and the more appropriate provision of necessary information in advance. The active contributions and high level of expertise demonstrated by external directors were also highly regarded, as in the previous year.

On the other hand, some comments were raised in light of the transition to a holding company structure, pointing to the need for further delegation of authority to the executive side and greater clarification of the roles of the Board of Directors. With the transition to a holding company structure scheduled for January 2025, the Company is expected to strengthen mechanisms to enhance the supervisory functions of the Board and facilitate more strategic discussions.

In response to this feedback, the Company will strive to further enhance the effectiveness of the Board of Directors by fully leveraging the specialized expertise of each director and reinforcing the formulation and oversight of advanced management strategies. The Company will also continue to maintain fair and transparent Board operations, with the aim of further building trust with investors and society, and enhancing corporate value on an ongoing basis.

2.6.Enhancing supervisory functions of the Board of Directors

The Company moved toward a Company with Audit and Supervisory Committee following a resolution at the Annual General Shareholders Meeting for the fiscal year 2015, held on March 21, 2016. From the standpoint of improving its corporate governance through the strengthening of supervisory functions of Board of Directors, the Company aims to increase corporate value in the mid- to long-term by using the capacity of External Directors who do not execute business. The Audit and Supervisory Committee, in which External Directors who are independent officers account for the majority of Members, properly audits and oversees the legality and appropriateness of business execution by Directors to realize transparency in management, with the ultimate aim of building a structure that can precisely meet the expectations of all stakeholders.

For example, the Company believes that, for the purpose of enhancing the supervisory functions of the Board of Directors, the later approval of the matters to be resolved at Board of Directors meeting would be prohibited, and all directors should be in favor of the later approval even if an exception is to be made, and has stipulated in Article 36 of the Articles of Incorporation of the Company to that effect.

The executive directors have powers over the important business execution, which are restricted under Article 36 of the Articles of Incorporation of the Company, so as to improve the Company's corporate governance through the strengthening of supervisory functions of Board of Directors.

The Company supports in various ways for corporate governance to fully function under the current structure, as represented by the establishment of the above provisions of the Articles of Incorporation.

Furthermore, we have adopted a group executive officer system as of January 2022 to strengthen and separate the business execution function of the group executive officers and oversight function over management decisions of the Directors. Independent External Directors will comprise a third of the members of the Board of Directors as a result of the change to the group executive officer system, strengthening oversight function over business execution at the Board, and the Company has a system to realize fair and transparent management.

3.Audit and Supervisory Committee

3.1.Roles, responsibilities and composition of the Audit and Supervisory Committee and Audit and Supervisory Committee Members

- 3.1.1

-

The Audit and Supervisory Committee, which is composed of a majority of outside directors, plays a role in overseeing management to achieve more transparent governance.

- 3.1.2.

-

The Audit and Supervisory Committee periodically receives reports from the department in charge of Internal Audit on the implementation status of internal audits and the results thereof, and is authorized to order and/or instruct additional audits as necessary as well as necessary investigations.

- 3.1.3

-

TheAudit and Supervisory Committee collaborates with the Financial Auditor to audit and oversee the status of execution of duties by Directors and execution of duties of departments in charge of business execution and group executive officers.

- 3.1.4.

-

The Audit and Supervisory Committee Members attend meetings of the Board of Directors and other important meetings, and as necessary, request reports from departments in charge of business execution to collect information on the status of execution of business of the Company.

4.Nomination and Remuneration Committee

- 4.1.1

The Nomination and Compensation Committee is an optionally established body.

- 4.1.2

An outside director serves as the chairperson.

- 4.1.3

All outside directors registered as independent directors with the Tokyo Stock Exchange, who are non-executive directors, are selected as members of the Nomination and Compensation Committee. To ensure independence, these outside directors make up the majority of the committee.

- 4.1.4

The committee reviews the nomination of candidates and compensation for directors (excluding those who are members of the Audit and Supervisory Committee) and group executive officers. The approach to compensation is detailed in "8. Remuneration."

5.Directors

5.1.Roles and responsibilities of the Directors

Directors are aware of their fiduciary responsibilities and execute the duties as Directors to increase corporate value in a sustainable manner.

- 5.1.1

Directors respect the GMO-ism.

- 5.1.2.

Directors fully understand the Company's policy to respect compliance, and comply with laws and regulations, the Company's rules, etc.

- 5.1.3

Full-time Directors are dedicated to their duties as Directors, without having any involvement in commercial activities conducted by competitors or other third parties.

- 5.1.4.

Full-time Directors will not assume the position of director, auditor, executive (shikkoyaku) or any other officer or employee of competitors except those approved by the Board of Directors or the Management Council.

5.2.Nomination of Directors

Nomination of a Director assumes self-nomination by each individual and is decided by the Board of Directors after consulting with the Nomination and Remuneration Committees which is composed of a majority of independent outside directors who are independent officers and after sufficient deliberation by all directors based on the results of discussions among the committee members while respecting them, taking into consideration factors including the following items: the nominee is capable of embodying the GMO-ism; the results of an 360-degree evaluation questionnaire targeted at all Directors of the Group; the quality, attitude, administrative capability, etc. as a member of the senior management and/or a Director. In this 360-degree evaluation questionnaire, all Members of the Board of the Group vote whether to recommend a given person as a candidate for the Board of Directors for the next fiscal year. If this does not fulfill certain requirements, a decision on whether to nominate the given person as a candidate to be reappointed will be made upon consultation with the Nomination and Remuneration Committees.

Nomination of a Director is decided by taking into consideration clear factors established by the Company and after consulting with the Nomination and Remuneration Committees that are capable of performing their functions from an objective and impartial standpoint, and we exclude arbitrariness from the human resource systems pertaining to directors of the Company.

5.3.Training policy

The Company's policy for training to Directors is based on the idea that each Director, as a professional of management, must endeavor to gain necessary knowledge and brush up one's skills at one's individual discretion, and thereby deepen and share knowledge and skills through in-depth discussions at the meetings of the Board of Directors and the Management Council.

Future candidates for Directors are given opportunities for training to gain necessary knowledge and understand the roles and responsibilities required by Directors by such means as attending the meetings and participating in discussions of the Board of Directors and the Management Council. The Company also provides training to each officer by inviting external specialists.

6.Independent Directors

6.1.Roles and responsibilities of the independent directors

Independent directors, based on their standpoint of independence, fulfill their oversight function over business execution, advisory function and oversight function over conflict of interest matters, and reflect stakeholders' opinions at the meetings of the Board of Directors, in an effort to enhance corporate governance.

- 6.1.1

-

Independent directors exchange information and share views on management of the Company with Audit and Supervisory Committee Members.

- 6.1.2.

-

Independent directors request the provision of information as necessary in order to fulfill their roles.

- 6.1.3

-

The status of concurrent positions held by independent directors is stated on the corporate governance report and the Notice of the Annual General Meeting of Shareholders.

6.2.Independence requirements

- 6.2.1

Independent directors are appointed based on independence requirements stipulated under the Companies Act and independence requirements formulated by the Company.

- 6.2.2.

The independence requirements are formulated by the Board of Directors subject to deliberation by the Audit and Supervisory Committee Members, and are published in the corporate governance report, etc. The details of the independence standards prescribed by the Company can be found in the "Independence Standards for External Directors" posted on the Company's website.

7.Group Executive Officers

7.1.Roles and responsibilities of the group executive officers

- 7.1.1

Group executive officers execute the business using skills and specialized knowledge required for the scope of business that has been delegated to them in regard to items that have been delegated to them by the Board of Directors and Representative Director.

- 7.1.2.

Delegation agreements provide for the relationship between the group executive officers and the Company, and group executive officers execute the business that has been delegated to them by the Company with due care by a good manager.

7.2.Appointment of group executive officers

The Company decides the appointment of group executive officers after the following process as is the case with the nomination of a Director. That is, the appointment of group executive officers assumes self-nomination by each individual, and is decided by the Board of Directors taking into consideration factors including the following items: the nominee is capable of embodying the GMO-ism; the nominee can execute the business appropriately and has experience in and specialized knowledge of the business in regard to items that have been delegated to the nominee by the Board of Directors; the results of an anonymous questionnaire survey targeted at all Directors of the Group; consulting with the Nomination and Remuneration Committees with major members comprised of the external directors who are independent officers; and respecting the results of discussions among the committee members.

8.Remuneration

8.1.Basic Views on Remuneration Package for Directors

The Company established a remuneration system linked to business performance, the level of achievement of performance targets, and other such factors, based on which the amount of the remuneration for Directors (excluding Directors who are Audit and Supervisory Committee Members) and group executive officers is determined, the purpose of which is to promote the sharing of common interests with shareholders along with providing an incentive for sustainable growth aiming at overall corporate value improvement. At the same time, the amount of the remuneration is determined after consulting with the Nomination and Remuneration Committees, so objectivity and transparency are ensured when deciding on the compensation.

8.2.Policy on Development of Remuneration Package for Directors

The committee consisting of several Members of senior management executives from all companies in the group who volunteered to become the committee members discuss whether a remuneration package for Directors is a fair compensation structure that places importance on the Company value and the shareholder value or the necessity to revise the current system. The Nomination and Remuneration Committees , which is composed of a majority of independent outside directors discuss the system established by the committee that has developed a remuneration package for Directors and the fairness and propriety of the amount of compensation payable to individuals calculated based on this system, which are resolved at the Board of Directors meeting after sufficient deliberation of the results of discussions among the committee members while fully respecting them. All Group companies have also adopted the said remuneration package for Directors. In addition to excluding arbitrariness from the remuneration system to ensure fairness, the annual amount of remuneration for all Members of the Board is disclosed to all officers and employees of the Group, thereby monitoring whether the treatment is fair and based on the professional responsibilities of Directors and the results.

8.3.Remuneration Package for Directors

Base Salary

Twenty-two evaluation items, including quantitative items such as sales and operating profit growth rates, and qualitative items related to GMO-ism, are scored within a set point distribution for each item, and the total is used to determine the evaluation results for the entire group as a company for the current fiscal year. The total of the points is used to determine the results of the Group-wide company evaluation for the fiscal year under review. The results of the evaluation are used to determine the compensation standards for each position, which have already been established.

Variable remuneration

The Company has adopted a fair and equitable remuneration system based on performance, professional responsibilities, and the results of each Director, by evaluating each Director individually based on action metrics, figures linked to the earnings in the department that a given Director is taking charge of, etc. in accordance with professional responsibilities of the Director in a given fiscal year, and by increasing or decreasing a variable remuneration within a range of 20% above or below the basic remuneration. Additionally, to further enhance sustainability management, we have incorporated ESG indicators into the individual targets of responsible executives.

8.4.Governance of Remuneration (Involvement of the Board of Directors and the Committee that Develops a Remuneration Package for Directors)

The Company discusses the revision as appropriate, the purpose of which is the right management of a remuneration package for Directors.

8.5.Decision-Making Authority over a Remuneration Package for Directors

For decisions on policies regarding determination on the amount of the compensation, etc. of the Company's Members of the Board and group executive officers or its computation method, the Committee establishing a remuneration package for Directors develops management guidelines as a result of designing, discussing, or revising the plan, compensation amount is calculated for each individual director and group executive officer pursuant to management guidelines, and the General Meeting of Shareholders delegate the authority to the Board of Directors to decide on whether the details of the amount of remuneration for Directors (excluding Directors who are Audit and Supervisory Committee Members) and group executive officers are appropriate after the consultation with the Nomination and Remuneration Committees , which is composed of a majority of independent outside directors.

The authority for deciding on the final compensation amount for each individual director and group executive officer is delegated to the Representative Director by the Board of Directors, who may make a minor adjustment that takes into account the calculation of compensation amount pursuant to the management guidelines. Even if the Representative Director makes a minor adjustment, the Representative Director will consult with the Nomination and Remuneration Committees about its appropriateness. Audit and Supervisory Committee has the authority for deciding on the amount of compensation payable to members of the board of directors who are Audit and Supervisory Committee Members.

9.Internal Control

At the Company, the Board of Directors resolves on the "system for ensuring proper operation of business" prescribed in the Companies Act and the Ordinance for Enforcement of the Companies Act. The overview is provided as follows.

In order to ensure swift execution of business based on appropriate controls, the Board of Directors oversees whether the legality and appropriateness of business execution by Directors and employees and the proper operation of business of the Group are ensured, as well as the structure and operational status of the Group's other compliance and risk management matters.

Furthermore, to ensure the accuracy of financial reporting, the company established and is operating an internal control system (commonly referred to as J-SOX, referencing COSO-ERM) that complies with the Financial Instruments and Exchange Act.

The details are stated in the "System for ensuring proper operation of business and implementation status of the system" in the Notice of the Annual General Meeting of Shareholders.

10.Financial Auditor

To ensure the reliability of information disclosure and responsibilities with respect to shareholders and investors, the Financial Auditor ensures and provides adequate time for conducting high-quality audits, a structure for collaborating with the Internal Audit Department and Directors who are Audit and Supervisory Committee Members, and access to the senior management.

- 10.1

-

The Financial Auditor collaborates with the Audit and Supervisory Committee to secure a structure that enables proper audits.

- 10.2.

-

The Financial Auditor ensures independence and expertise.

- 10.3.

-

The Financial Auditor abides by quality control standards required for proper accounting audits.

11.Approach to the Independence of Listed Subsidiaries

The Company owns the following listed subsidiaries: GMO Payment Gateway, Inc.; GMO Internet, Inc.;GMO GlobalSign Holdings K.K.; GMO Pepabo, Inc.; GMO Financial Holdings, Inc.; GMO Research & AI, Inc.; GMO TECH, Inc.; GMO Media Inc. ; and GMO Financial Gate, Inc.

The Company considers that the basis of group management is the distribution of authority and to pursue group-wide synergies based on the idea that self-reliant organizational operation through a flat organization is the effective management structure in a rapidly-changing Internet market. GMO Internet Group is aware that listing is able to accelerate growth. Under the Venture Spirit Declaration, the one of GMO-ism, which embodies the spirit in which the Company was founded, we believe "A company is a tool for the happiness of everyone involved, including colleagues, shareholders, and customers. The barometer is a smile." On this assumption, we believe that we can: enhance the visibility and the public confidence in the organization and gather excellent human resources through the listing on the stock market; improve the group enterprise value by generating benefits as a result of bringing smiles to our customers through our No. 1 services; and properly return value to minority shareholders. Our investment in group companies is based on the principle of holding a majority of the shares directly or indirectly, and we aim to obtain a controlling stake as much as possible. By sharing the GMO-ism, while respecting the independence of above listed subsidiaries, Directors and partners (employees) maintain and enhance awareness of laws and regulations, ethics, etc. on an ongoing basis, are encouraged to work together, as well as generate group-wide synergies, so as to further enhance the corporate value of the Company.

The Company, as a parent and major shareholder, always remains sufficiently vigilant to the legal compliance system of above listed subsidiaries, and supports and provides advice on certain matters concerning compliance, building an internal control system, etc. if necessary and as appropriate, for the purpose of enhancement of the overall group's corporate value.

Updated on March 21, 2025

Updated on August 30, 2024

Updated on March 22, 2024

Updated on July 18, 2023

Updated on March 24, 2023

Updated on March 20, 2022

Updated on December 20, 2021

Updated on March 20, 2021

Updated on March 30, 2020

Updated on December 17, 2018

Updated on June 5, 2017

Established on May 9, 2016